It’s a wacky time for self-employed folks and small businesses. While some small businesses are seeing their revenue streams dry up temporarily, others are scrambling to keep up with unprecedented demand and opportunities for growth. Depending on your industry, it’s possible to actually grow your small business during this bizarre economic time.

But sorting through the torrent of coronavirus-related resources is like guzzling water from a fire hose, especially with everything else you need to do to keep your small business thriving.

To help you out, our In The Rooms research team has put together this reference guide with a list of handy links. Bookmark it for quick, easy access to the help you need. If you’ve found helpful resources on your own, we’d love for you to share them in the comments.

Federal Loans and Grants for Small Businesses

On March 27, President Trump signed into law the $2 trillion Coronavirus Aid, Relief, and Economic Security Act. Because Congress loves a good acronym even during the hardest of times, it’s called the CARES Act, and you can read the full text here.

Small businesses employ 48 percent of Americans, so Congress understands that helping small businesses means helping American workers. CARES earmarks $349 billion for small business loans backed by the U.S. Small Business Administration (SBA). The loans are designed to help small businesses make payroll, rent, and utilities. Some loans would convert to grants that you don’t repay as long as you meet certain conditions, reports The Wall Street Journal.

NOTE: These new, COVID-19-related loans are different from the SBA loans many small businesses are already familiar with. Inc. explains the differences here.

The Chamber of Commerce has prepared this checklist to help small businesses understand and apply for the COVID-19-related SBA loans.

Unemployment Benefits for Self-Employed Workers

Usually independent contractors aren’t eligible for unemployment. However, if you’re a freelancer and your gigs are drying up, you may be eligible for unemployment benefits during this extraordinary time. This Business Insider article explains how it works.

This CareerOneStop.org link helps self-employed workers research and apply for unemployment benefits in their states.

One-Time Coronavirus Relief Checks

Some Americans will receive one-time checks for $1,200. No one needs to apply for these funds. Eligible Americans will receive checks in about three weeks, officials say.

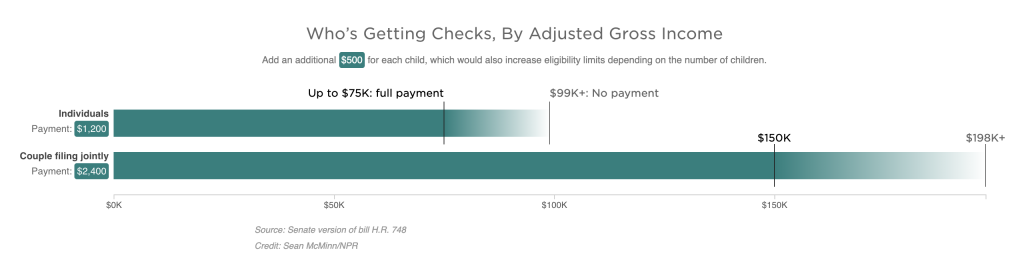

There are all kinds of complicated provisions related to 2019 gross income, which NPR has simplified in this graph.

Admittedly, 2019 already seems like a million years ago. If you can’t remember your adjusted gross income for 2019, it’s on Line 8b of your 1040 federal tax return, the New York Times explains.

Big Business Lend a Hand to Small Businesses, Self-Employed Workers

Entrepreneur has compiled this list of 65 technology products and services that are free during the pandemic. The site will update the list regularly for the foreseeable future.

Inc. has compiled a similar list, as well as this handy small business survival guide to help your small business navigate coronavirus challenges.